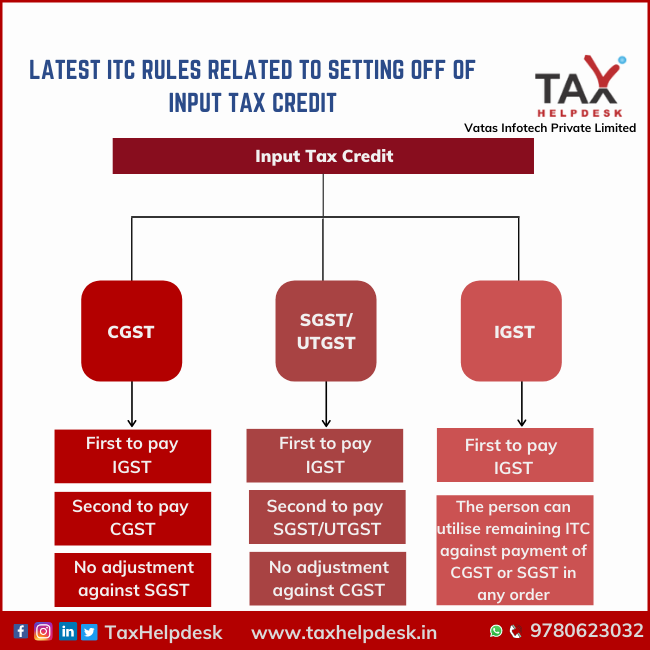

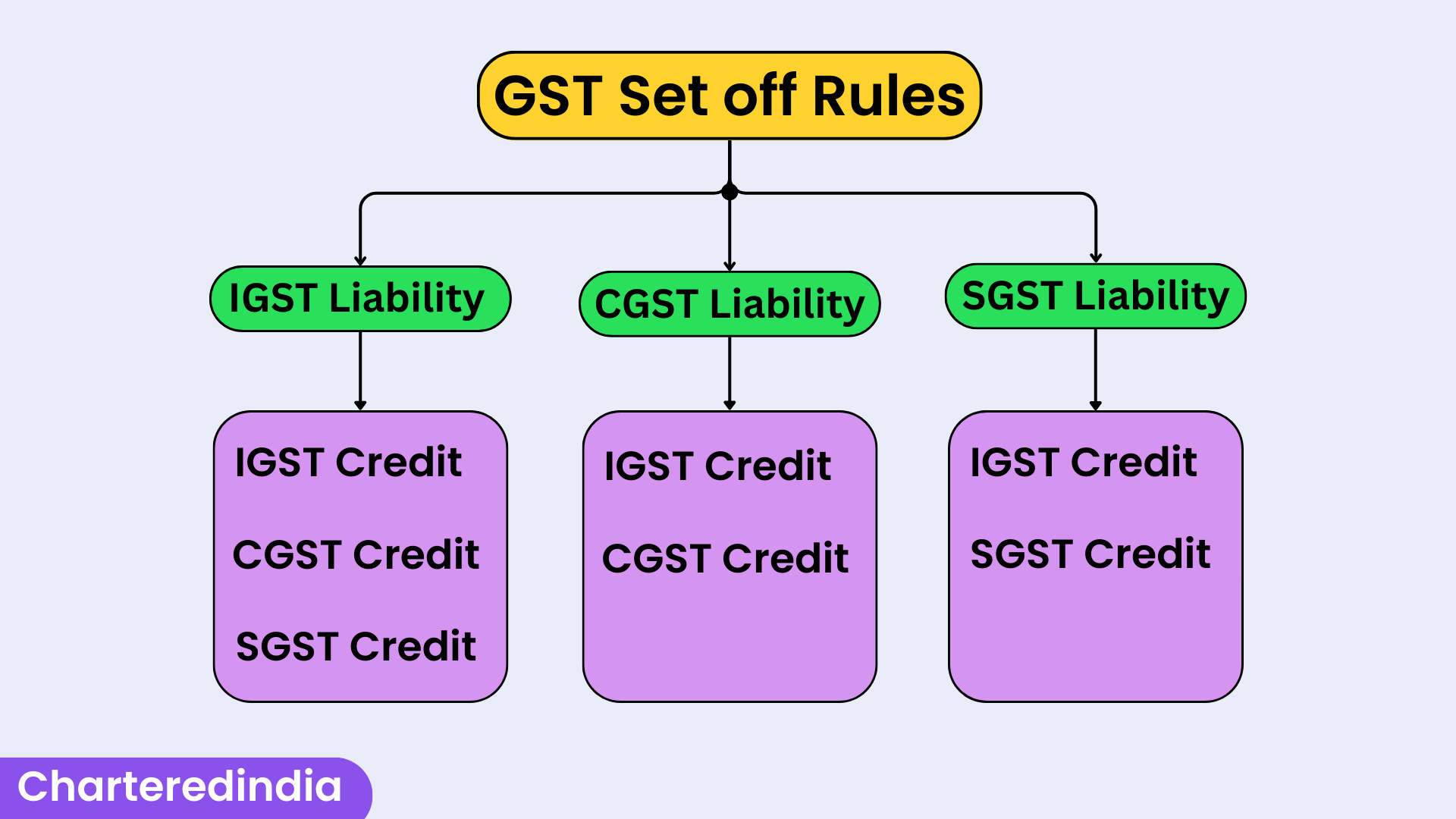

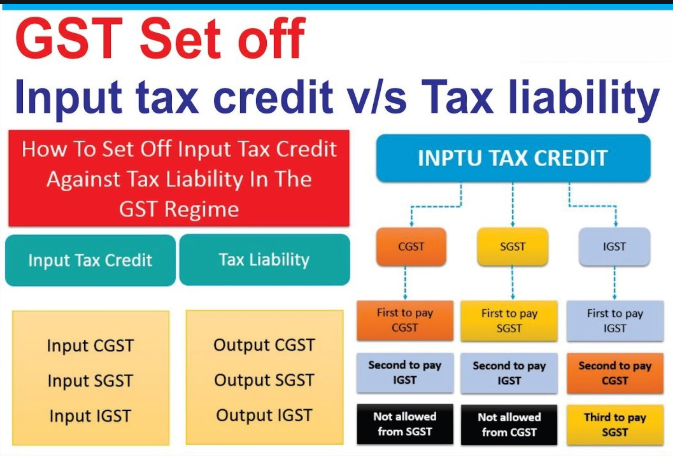

03 GST ITC Set Off Rules And Journal Entries | GST Payment Journal Entry | GST Refund Journal Entry - YouTube

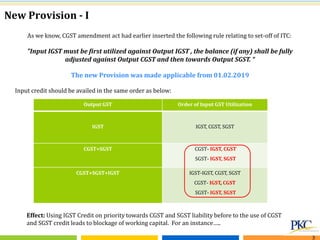

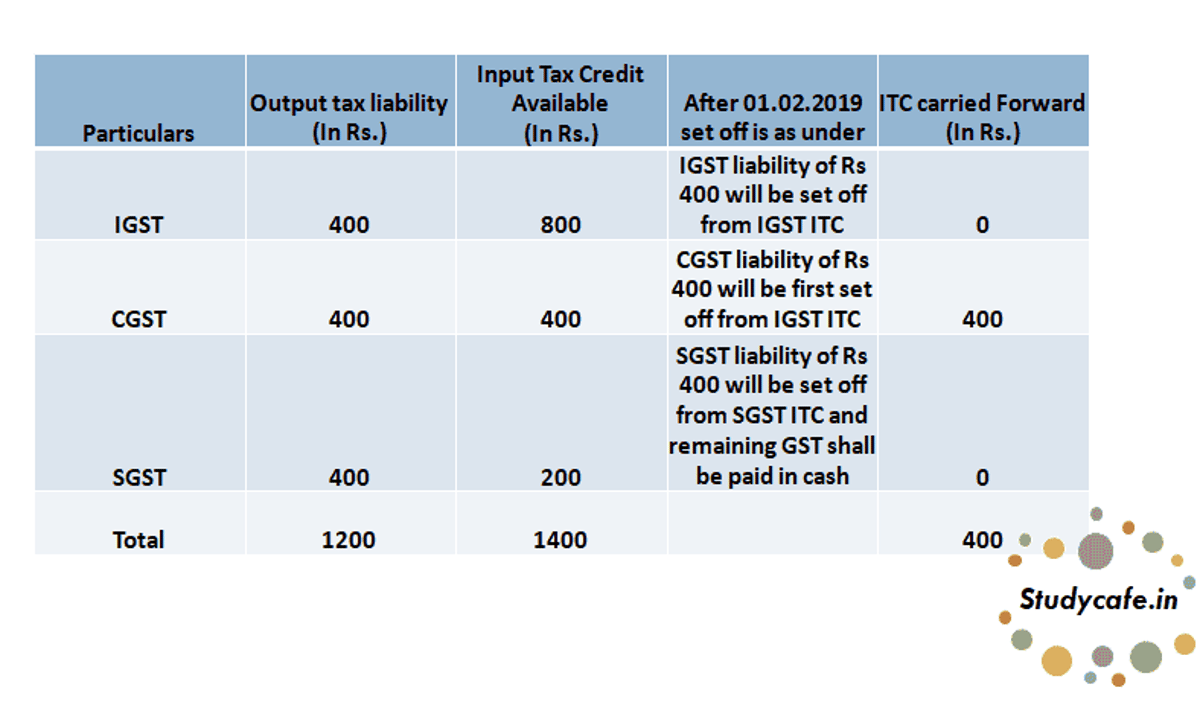

Goods and Service Tax (GST) Configuration (Tax Hierarchy and Set off Rules) in Microsoft Dynamics 365 Finance and Operations -Part-5 – Explore Microsoft Dynamics 365 Finance and Operations Together